Dans l’univers digital, la création d’un site WordPress se révèle être un atout majeur pour les entrepreneurs et créateurs de contenu. Ce guide explique pour…

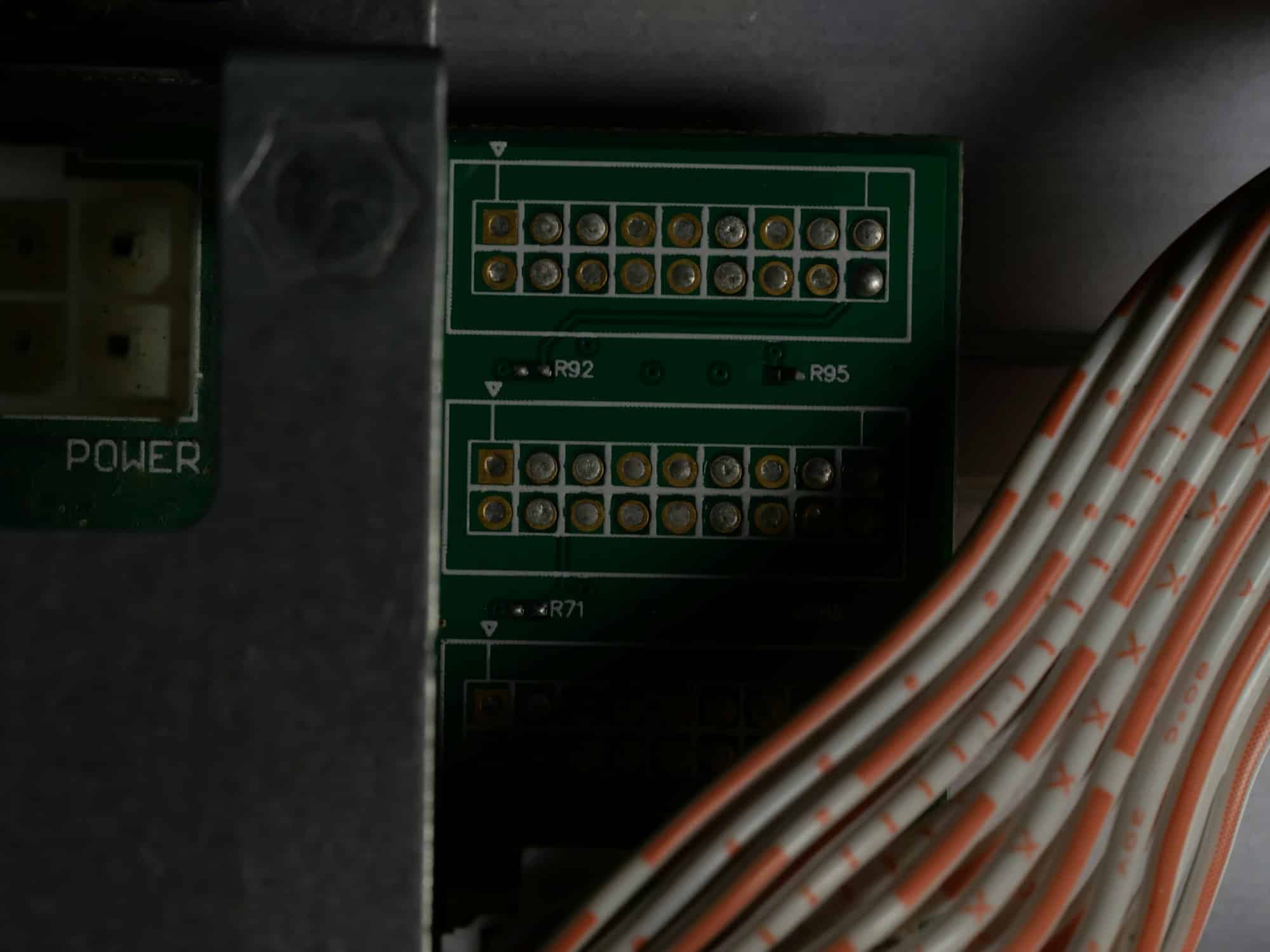

Assurez la fiabilité de votre réseau avec une baie de brassage étanche

Votre réseau d’entreprise mérite une protection sans failles. Face à des agents environnementaux imprévisibles, choisir une baie de brassage étanche, c’est opter pour une fiabilisation…

Création site internet à lyon : l’importance de la plateforme pour votre commerce

S’armer d’un site internet performant transfigure le paysage commercial lyonnais. Élaborer une plateforme en ligne devient un atout indéniable pour accroître la visibilité et la…

Comparatif montre garmin : dénichez le modèle qui vous convient

À la recherche de la montre Garmin parfaite pour accompagner vos exploits sportifs ou simplement pour enrichir votre quotidien ? Pour ce faire, il vous…

Conseils pour choisir un outil de création de chatbot ?

Intégrer le chatbot dans sa stratégie de marketing est devenu une pratique de plus en plus courante et stratégique pour chaque entreprise qui souhaite améliorer…

Découvrez le potentiel de ChatGPT : Transformez votre expérience en ligne !

Découvrez le potentiel révolutionnaire de ChatGPT, l’IA conversationnelle de pointe qui transcende les frontières traditionnelles de l’interaction en ligne. En associant la puissance de l’intelligence…

Trouvez réponse à vos questions avec le Chatbot GPT

À l’ère du numérique où l’information est reine, le Chatbot GPT se révèle être un allié précieux. Décryptez la mécanique de cet outil intelligent :…

Générateur d’image par IA : personnalisez vos images !

À l’ère digitale, la personnalisation visuelle devient règle d’or. Les générateurs d’images assistés par intelligence artificielle révolutionnent cette quête de l’unicité. Décryptez leur fonctionnement, saisissez…

Quels sont les avantages des vendeurs en ligne avec la stratégie multi-sites ?

À l’ère du commerce électronique en constante évolution, la stratégie multi-sites se révèle être un atout considérable pour les vendeurs en ligne. Idéalement, pour ceux…

Quelles sont les informations utiles concernant les bobines TPE ?

Un terminal de paiement électronique, TPE est un appareil électronique qui favorise les paiements électroniques au cours des achats. Pour le bon fonctionnement de cet…